Latest research reveals that UK consumers are more worried about energy prices than unemployment or inflation. But what are the implications of this for PR professionals?

Many press and publicity pitches appeal more to media outlets if PR professionals fit them into a broader economic context. The Bloomberg/YouGov Household Economic Activity Tracker provides insight on what economic themes are emerging.

Right now, the tracker shows that the sluggish economy is worrying UK consumers. Ways to tell this story include specifics about where consumers are cutting back (and even increasing spend), worries about petrol prices, and to raise awareness of the small segment of consumers that are becoming more positive.

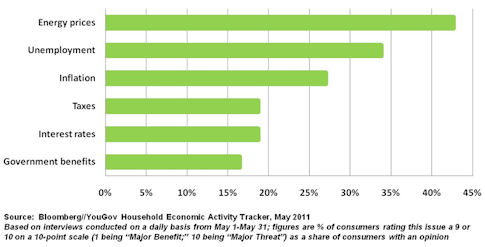

What consumers believe are the biggest threat to the economy:

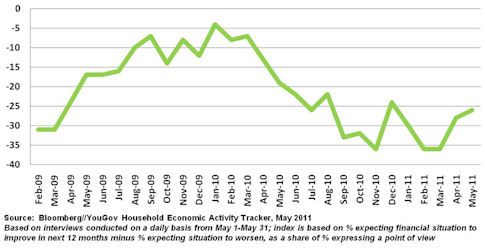

Although UK consumer outlook is rebounding from earlier this year – which posted the lowest figures we’ve measured so far – consumers are still quite pessimistic (16 per cent expect the financial situation to improve in the next 12 months versus 40 per cent expecting it to worsen). Consequently, news stories about penny-pinching are still relevant.

Expected Household financial situation, next 12 months:

With 51 per cent of consumers more price conscious than a year ago (versus only 1 per cent who are less price conscious), discretionary spending is taking a hit. Over the past 12 months, 24 per cent of consumers cut back on dining out (versus 10 per cent spending more); 27 per cent cut back on buying clothes/shoes (versus 12 per cent spending more); 16 per cent cut back on going to pubs and bars (versus just 6 per cent spending more).

Publicity highlighting consumers finding new ways to cut spending, taking advantage of store promotions, or using coupons should gather the most interest from editors. Similarly, content about consumers finding new ways to have fun more cheaply may resonate. For example, coverage of people staying at home in order to have fun fits with what consumers are doing: more have increased spend on cable TV (14 per cent) than cut it (7 per cent), while more have cut back on going to the movies (10 per cent) than increased spend (4 per cent).

Petrol fears

Continued pain at petrol stations worries Britons more than any other economic issue. 43 per cent of Britons view it as a serious threat (rating a 9 or 10 on a 10-point scale), significantly higher than unemployment. 90 per cent of consumers expect energy prices to increase in the next year (versus 81 per cent expecting price increases generally), with 39 per cent expecting energy prices to increase “a lot.” This worry is seen in consumer fears of inflation – with consumers expecting inflation of around 5 per cent over the next 12 months. Energy price themes will continue to resonate with readers and editors alike.

Optimistic sparks

A small set of consumers – 19 per cent – have reasons to be optimistic. This group is expecting to receive a raise, promotion, or bonus in the next 12 months. This population is generally better off (51 per cent have household incomes at or over £40,000). Briefs for outlets that serve this population (such as financial titles and certain lifestyle titles) should focus on relevant content such as managing improving income in challenging times.

In all cases, understanding specifics about how consumer sentiment is adjusting to the “new normal” can help top publicists better place their client’s content.

Methodology

The Bloomberg/YouGov Household Economic Activity Tracker is a monthly survey of over 7,000 UK residents. This latest instalment was conducted from 1 May to 31 May 2011.

Michael Nardis is head of YouGov Investment Products and is based in New York. If you would like more information on Bloomberg//YouGov HEAT email him at mike.nardis@yougov.com.

If you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: