Bankers and bonuses go together like strawberries and cream, but they leave a nasty taste in the mouth for those who are struggling to simply keep their jobs right now. It is just over a year since the Royal Bank of Scotland (RBS) and Lloyds Banking Group were bailed out by the Government, and in early November, both banks agreed to defer bonuses for this year and break up their businesses in return for more government support. Each bank said it would not pay discretionary cash bonuses for 2009 to any staff earning above £39,000.

Research supplied by Echo Sonar

However, this did not silence the media when it came to criticising the banks and their bonus systems, especially now, as the Government strikes a further blow against them. In his pre-Budget report on 9 December, chancellor Alistair Darling announced a one-off tax on bank bonuses over £25,000. But is the Government simply trying to gain good publicity by picking on bankers’ bonuses, and what can the banks do to improve the way they are perceived?

One idea tried this summer by

Barclays and

HSBC was to liken their senior staff to more popular public figures. As the

Guardian.co.uk reported on 3 August, “the banks compared their high-flyers to footballers and Hollywood stars to try to explain the need for the hundreds of thousands of pounds individuals are expected to receive this year.” And according to

www.chinapost.com on 10 September, executives from Credit Suisse Group AG, Morgan Stanley and Deutsche Bank AG also tried to defend bonuses by saying they were good for business: “’Bonus payments alone have not caused the financial crisis,’

Credit Suisse Vice Chairman Urs Rohner told the annual Banks in Transition conference”.

Those working to boost the profile of bankers are really struggling at the moment, especially following the backlash Lloyds received after its announcement of its latest bonus payments.

Mirror.co.uk, summed up national feeling on 5 December with its headline: “Fury at Lloyds £18million handout for bosses as job and pay for frontline staff are slashed.”

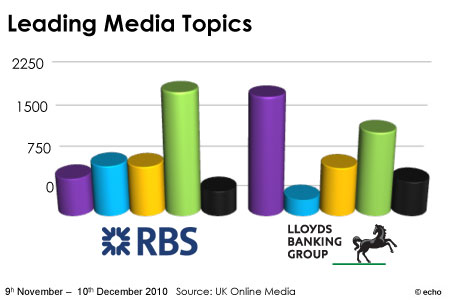

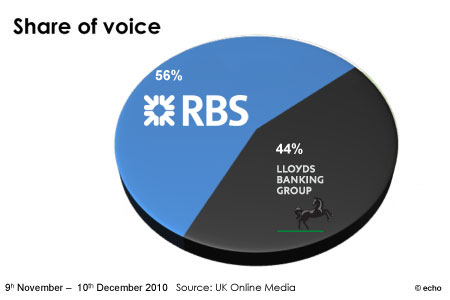

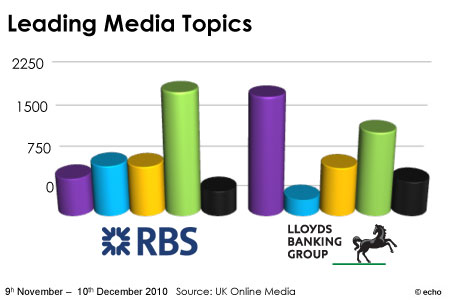

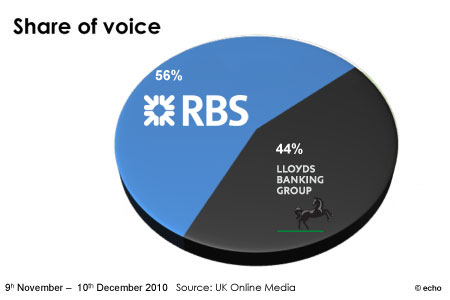

Lloyds may dread seeing the word ‘bonus’ in the headlines next to its name, but according to research sponsored by PRmoment, the words ‘job cuts’ are causing it more grief. Analysing online coverage of Lloyds and RBS in the last month shows that RBS has slightly more coverage and that bonuses are the main topic of stories for this bank. For Lloyds, there are over three times more mentions of job cuts than bonuses, and bonuses are mentioned only a third as often as in RBS stories. Job cuts news often focuses on unions’ outrage, for example on 11 November,

Independent.co.uk reported: “Unions reacted with fury yesterday after Lloyds Banking Group announced another round of job cuts. The company is planning to axe 5,000 posts by the end of next year, part of the continuing fallout from the shotgun wedding of Lloyds TSB with HBoS that rescued the latter from likely collapse.”

It may be a struggle for the PR machines at Lloyds and RBS to come up with strategies to defend themselves now, especially as it looks like the Government is using banks as a scapegoat. However, Andy Barr, co-founder of PR agency

10 Yetis, who previously worked in financial services PR, believes the banks could have handled the press more successfully, although he admits it is tough right now, as the banks: “are getting battered from every angle”. His advice is for the banks to get more involved in community projects to get grass-roots support. In the corporate world he suggests: “They should try to be more transparent, and less obstructive in responses to questions. If they had been open from the start and managed responses better, rather than using delaying tactics, they would be in a better position now.”

Methodology

PRmoment asked Echo Sonar to analyse all UK media coverage of Lloyds Banking Group and Royal Bank of Scotland . The research period was from 9 November until 8 December 2009. Metrics included share of voice and topics.

![]()