Year on year, reputation has become increasingly recognised as the important asset it is for businesses.

Year on year, reputation has become increasingly recognised as the important asset it is for businesses.

On becoming Barclay’s chief executive, Antony Jenkins spent a lot of time, within the bank and in the media, talking about his plans to rebuild the bank’s reputation. He talked about it as much as he talked of profits and shareholder value.

It is however no surprise that Jenkins spent so much time talking about reputation. The financial crisis saw bankers become bogeymen; they faced a raft of regulatory, legislative and consumer pressure that is in many ways unparalleled. It’s a reminder that those who fail to take their reputation seriously often see their sector hit with added regulation and increased costs.

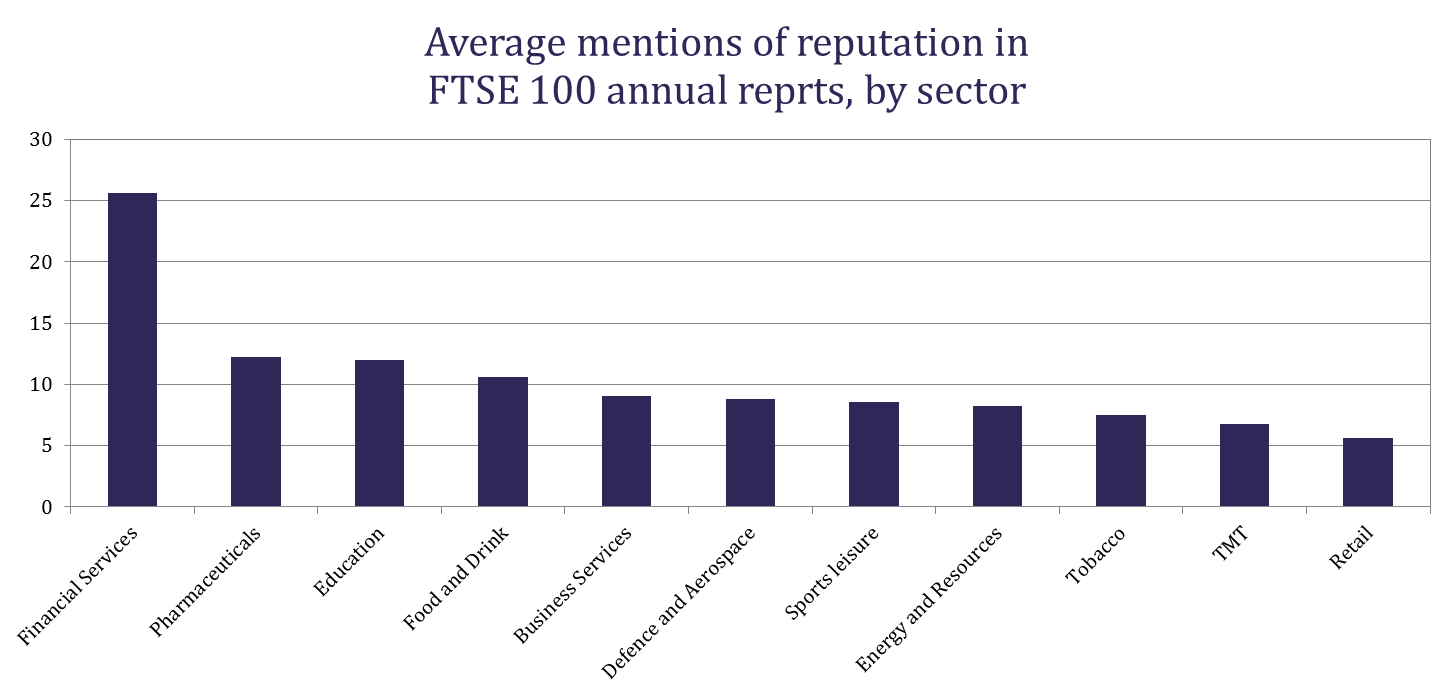

Research by communications agency Hanover has revealed that Antony Jenkins isn’t the only one in financial services to start taking the issue of reputation more seriously:

The study of FTSE 100 annual reports revealed that, on average, financial services companies mention reputation more than twice as much as companies from other sectors within their annual reports. This is particularly the case for firms with a significant UK retail banking presence, with Barclays mentioning reputation 111 times.

The rankings also highlight that while mentions of reputation and risk tend to be higher for the sectors that face increased levels of regulation, such as pharmaceuticals, mentions drop for sectors such as technology media and telecoms (TMT) and retail. And while understanding and dealing with risk is an important part of building and protecting an organisation’s reputation, it is a worrying trend to find that overall there are 30 times more mentions of risk to reputation within the FTSE 100 annual reports.

This analysis is important because the companies talking about reputation are also those taking it most seriously. Annual reports, although dense and often unread documents, are a good barometer for understanding the priorities at the top of an organisation. Companies that do not talk about reputation in their reports, are unlikely to be talking about it in the boardroom. This ranking is a useful proxy metric for identifying those who are taking proactive steps to ensure their businesses are building reputations that insulate them when a crisis strikes.

It’s clear that the credit crunch and the rise of “banker bashing” has focused minds in the financial sector. However, as the reaction to energy price rises at the end of 2013, the recent floods and the numerous data breaches that have recently occurred have shown, no sector is immune from crisis.

As Antony Jenkins can no doubt explain after the hammering Barclays recently suffered when it announced job losses, lower profits and higher bonuses, rebuilding a reputation after a crisis is a long and difficult process. Companies and their boards must focus on building and insulating their reputations before crises strike.

Methodology

Hanover analysed the most recent annual reports of all FTSE 100 companies in the final two weeks of November 2013. Searches were conducted for the words “risk” and “reputation” and any associated terms (i.e. “riskiness“) and totals noted. Companies were then grouped into sectors and sector averages (arithmetic mean) of the tallies were calculated.

Written by Gavin Megaw, director, Hanover Communications

PR Masterclass: The Intersection of PR and GEO

Wednesday 25th February, both virtual and in person tickets are available.

PR MasterclassIf you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: