There may be hope that we are coming out of recession, but last year, the amount of businesses which failed still increased. However, the good news is that the insolvency rate for 2011 rose only slightly compared to 2010, according to figures from The Insolvency Index from information services company Experian. Max Firth, UK managing director for Experian’s business information services division, said: “Given the challenging economic climate in 2011, businesses in the UK were pretty resilient and this was reflected by the stable insolvency rate during the year".

“The fall in the overall rate of insolvencies has taken it back down to the level it was at a year ago, which is certainly positive. January generally tends to be a good month, with many businesses benefiting from the Christmas trade. When coupled with steady improvements in the underlying financial strength of businesses, it means that we can entertain some cautious optimism for the months ahead.”

Regional differences

If you are looking to develop your business, which UK region should you focus on? It seems that Yorkshire is the most hopeful spot. This was the only region to see the insolvency rate fall. Here there was an improvement from 1.46 per cent (1,724 companies) in 2010 to 1.39 per cent (1,653) in 2011. This is the second successive year the region has seen the insolvency rate fall.

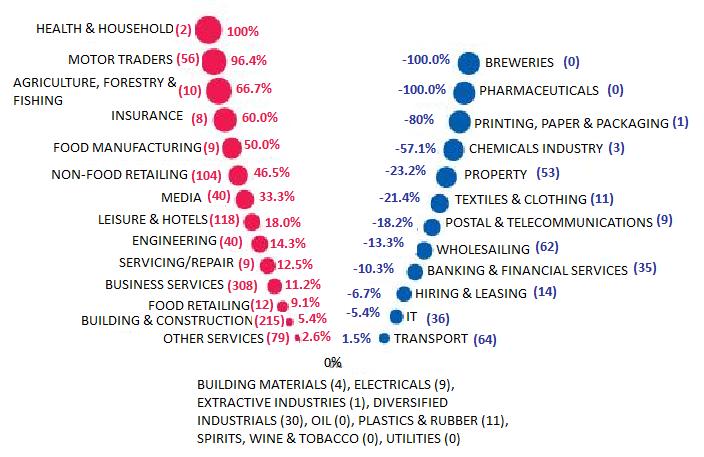

% change from January 2012

.jpg)

Source: Experian, Experian Insolvency Report 2012

Wales did not fare so well. Here the insolvency rate jumped from 1.01 per cent (569 companies) in 2010 to 1.18 per cent (654) in 2011. Scotland, which has experienced significantly lower levels of insolvencies compared to other regions since 2005, came more into line with the rest of the UK with an insolvency rate of 0.93 per cent.

Best business sectors

For those wishing to focus on specific sectors, you may wish to move into property. Of the five largest industries in the UK – business services, building/construction, property, IT and leisure/hotels – property saw the biggest fall in its insolvency rate from 0.09 per cent in December to 0.04 per cent in January. It was also the only one of the big five to see a year-on-year fall – from 0.05 per cent in January 2011.

Number of insolvencies from January 2012

Source: Experian, Experian Insolvency Report 2012

Businesses within the building/construction sector saw by far the biggest improvements in financial strength – from 77.98 in January 2011 to 82.91.

Size matters

It seems big business has been the worst hit by increases in insolvencies. Firth explains: “There has been an increase in the rate of insolvencies for the largest firms This highlights that despite a positive start to 2012, businesses of all sizes still need to understand the risks they are exposed to and have strategies in place to protect themselves.”

Small companies, with just one or two employees, managed to maintain the lowest rate of insolvencies compared to their larger counterparts. Companies that suffered the best year-on-year improvement in financial strength, were those that had between 51 and 100 employees.

Background

The Insolvency Index is a regular index from information services company Experian. The insolvency rate is calculated by comparing the number of businesses that failed with the total business population in Great Britain.

If you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: